Team building expenses hit corporate budgets hard. Under the 2025 UAE Corporate Tax Law, staff entertainment expenses including company parties and team-building activities are 100% deductible. This tax treatment differs dramatically from client entertainment costs.

Understanding tax implications determines whether your AED 50,000 desert safari counts as fully deductible employee welfare or partially deductible entertainment. Misclassification triggers tax adjustments and penalties.

Quick Answer: 7 Key Tax Facts About Team Building Events

- Employee-only events: 100% tax deductible

- Mixed client-employee events: Only employee portion fully deductible

- VAT on staff events: Recoverable input tax

- Documentation required: Invoices, receipts, attendance lists mandatory

- Private family events: Not deductible even for staff

- Corporate tax rate: 9% on profits above AED 375,000

- Registration threshold: Required if annual revenue exceeds AED 1 million

Detailed guide below.

Understanding UAE Corporate Tax for Team Building Events

The UAE implemented Federal Decree-Law No. 47 of 2022 introducing corporate tax effective June 1, 2023. UAE taxes income on both residence and source basis with resident persons taxed on income from domestic and foreign sources.

All companies and commercial activities in the UAE face 9% corporate tax unless explicitly exempted. The standard rate applies to taxable income exceeding AED 375,000, with a 0% rate below this threshold.

Team building events qualify as employee-related expenditures under Article 28 of the Corporate Tax Law. Entertainment expenses incurred exclusively for employees are fully deductible provided they are wholly and exclusively for business purposes.

This distinction matters financially. A company spending AED 100,000 on team building saves AED 9,000 in corporate tax through the full deduction. The same amount spent entertaining clients saves only AED 4,500 due to the 50% limitation.

Employee Events vs. Client Entertainment: Critical Differences

Employee-Only Team Building Events

Examples of fully deductible employee entertainment expenses include staff meals during office hours, year-end staff parties, annual team-building events, internal training programs with meals, employee rewards or recognition events, and office refreshments.

Expenditure for employee entertainment such as staff parties, off-site events, away-days or rewards for meeting performance targets are employee-related expenses fully deductible for Corporate Tax purposes.

Understanding what is team building helps companies structure activities to maintain full tax deductibility while achieving development objectives.

Mixed Events Including Clients

Where entertainment expenditure is not wholly and exclusively incurred for business purposes, a Taxable Person must identify the appropriate proportion to be treated as entertainment expenditure with only 50% of that proportion deductible.

Events mixing employees with clients, suppliers, or business partners require expense apportionment. Calculate the employee portion separately and apply 100% deductibility to that segment only.

Private Nature Exclusions

If an expense is incurred for an event private in nature such as a wedding for family members who happen to also be staff, it will not be deductible for Corporate Tax purposes.

Personal celebrations don’t become deductible simply because attendees hold employee status. Business purpose remains the qualifying criterion.

VAT Treatment for Team Building Activities

Standard VAT Rate and Registration

Value Added Tax applies at 5% standard rate on most commodities and services in the UAE. Businesses with taxable turnover over AED 375,000 must register for VAT via the UAE Federal Tax Authority portal.

Team building service providers charge 5% VAT on their invoices. Companies registered for VAT can recover this input tax when the event qualifies as employee entertainment.

VAT Recovery on Staff Events

VAT on business entertainment expenses is generally non-recoverable for client-related costs but recoverable for staff-related entertainment. This recovery right provides additional tax benefit beyond corporate tax deductibility.

A company paying AED 105,000 including VAT for a team building event recovers the AED 5,000 VAT component while deducting the full AED 100,000 base cost from taxable income.

Documentation Requirements

Strong record-keeping including detailed invoices and proof of business purpose is mandatory to substantiate deductions and withstand audit scrutiny under UAE regulations.

Maintain tax invoices showing supplier Tax Registration Number, event date, attendee lists confirming employee-only participation, and written documentation of business objectives served.

Common Team Building Expenses and Tax Treatment

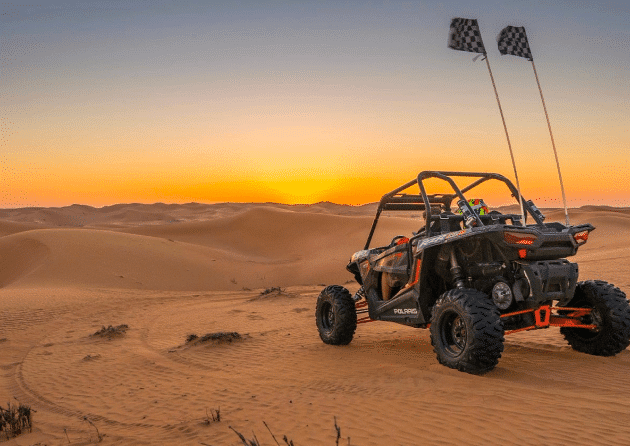

Desert Safari Corporate Events

Team-building desert safaris fall under deductible entertainment if they advance business goals generating taxable income. Dubai’s adventure tourism offerings create popular team development venues.

Companies organizing corporate events through specialized providers receive proper tax documentation supporting full deductibility. Evening desert experiences combining dune bashing, cultural activities, and traditional dining qualify when restricted to employees.

Transportation and Accommodation

Accommodation, transportation, or venue hire for corporate hospitality events qualify as entertainment expenditure if exclusively incurred for business purposes.

Chartered buses transporting teams to offsite events, hotel accommodations for multi-day retreats, and venue rental for team activities all receive 100% deduction when serving employee-only groups.

Meals and Refreshments

Entertainment expenditure includes expenditure in connection with meals, accommodation, transportation, admission fees, and facilities used in connection with such entertainment.

Catering costs for team lunches, breakfast meetings, or dinner celebrations during employee events qualify for full deduction. Separate meals with clients during the same trip require expense segregation.

Recreational Activities

Recreational activities from team-building desert safaris to yacht charters fall under the umbrella if they advance business goals. Activity-based team building including sports, adventure challenges, or wellness programs qualifies.

The importance of team building justifies these expenses as employee welfare investments rather than mere entertainment.

Documentation and Compliance Best Practices

Essential Records to Maintain

Maintaining detailed documentation including invoices, receipts, and clear justifications of business purpose is mandatory. Create comprehensive files for each team building event.

Required documentation includes:

- Supplier tax invoices with TRN numbers

- Attendee lists confirming employee participation

- Event agendas showing business objectives

- Payment records and bank statements

- Written approvals from management

- Photos or reports demonstrating event execution

Expense Tracking Systems

Implementing strict internal expense approval policies and using digital expense tracking tools significantly reduces risks related to mixed-purpose entertainment events and misclassification.

Digital systems automatically flag mixed events requiring apportionment, attach required documentation to transactions, and generate audit-ready reports showing full compliance trails.

Avoiding Common Classification Errors

Companies frequently misclassify expenses causing audit exposure. Family members attending staff events, private celebrations disguised as company functions, and inadequate separation of client-employee costs trigger most disputes.

Effective team building planning includes tax consideration from initial budgeting through execution ensuring full deductibility qualification.

Audit Preparation

Federal Tax Authority audits examine entertainment expense claims closely. Prepare by conducting internal reviews quarterly, correcting misclassifications before filing, and maintaining organized documentation exceeding minimum requirements.

Corporate Tax Registration and Filing Requirements

Registration Thresholds

If 2024 business income exceeded AED 1 million, the deadline for corporate tax registration is March 31, 2025. Companies meeting revenue thresholds must register regardless of profitability.

The FTA imposes strict penalties for late registration starting from AED 10,000. Proactive compliance proves cheaper than reactive penalty payments.

Tax-Free Threshold Benefits

UAE offers a generous tax-free threshold of AED 375,000 on taxable profits meaning if net profit is below this amount corporate tax liability is zero.

Small companies investing heavily in team building may reduce taxable profit below the threshold through full deduction of these employee welfare expenses.

Filing Deadlines and Obligations

You have 9 months after the end of your financial year to file with calendar-year filers’ 2024 tax return due by September 30, 2025.

Returns detail all deductible expenses including team building. Accurate categorization during the year simplifies filing and reduces errors triggering audits.

Maximizing Tax Benefits for Team Building

Strategic Event Planning

Schedule employee-only events separately from client entertainment to maintain clear deductibility. Host team building activities during distinct periods avoiding overlap with client-facing occasions.

Budget team building as employee welfare investment qualifying for preferential tax treatment rather than generic entertainment expense.

Combining Multiple Benefits

Team building expenses deliver triple financial advantages: full corporate tax deduction reduces tax liability, VAT recovery returns input tax paid, and improved employee retention saves recruitment costs.

Calculate total tax benefit by adding corporate tax savings and VAT recovery. A AED 100,000 event saves AED 9,000 in corporate tax plus recovers AED 5,000 VAT for total AED 14,000 benefit.

Professional Guidance

Tax rules evolve continuously. The UAE’s Federal Tax Authority publishes updated guidance while professional accounting firms like PWC provide specialized advisory services.

Consult tax professionals before major team building investments ensuring proper structuring, documentation, and compliance with current regulations.